APPENDIX 9

USE CASES

INTRODUCTION

The BFSI industry is projected to be one of the largest Metaverse markets in the upcoming years, behind only Media and Entertainment, with an estimated 30% of the global market size (Grandview). The opportunity for growth in this area will occur both in bringing existing services to the immersive, digital realm, as well as through creative new markets created by the digital realm. Metaverse opportunities will require creativity and innovation. It will be a challenge to avoid FOMO hype and busts, while not missing out on key opportunities and being left behind.

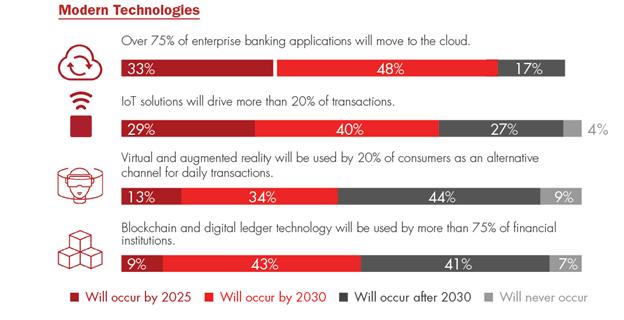

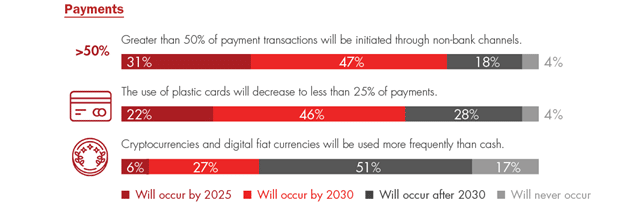

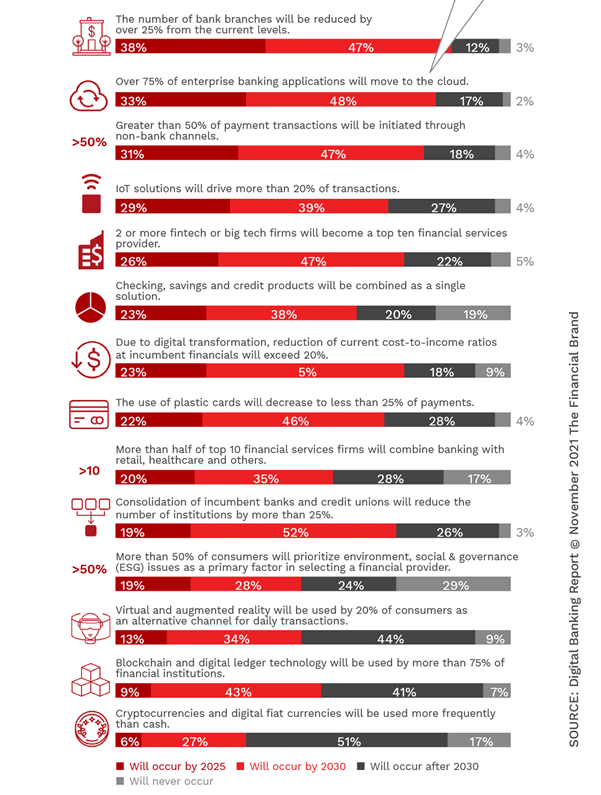

The projected speed of adoption of some projections (e.g. use of cloud computing and industry consolidation) can’t be ignored. Likewise, the slowness of other projections (e.g. impact of social responsibility and use of crypto) should not be assumed. (The Financial Brand)

The “decentralized” Metaverse will still be populated by traditional banks and fintech companies looking to expand their commercial footprint. It will be interesting to see whether the Metaverse remains “centralized” and dominated by these companies, or whether it transitions to a truly “decentralized” space: “decentralized finance (DeFi), and collateral management could well come into play, and that, rather than traditional finance companies, this could be done by decentralized autonomous organizations (DAO)” (Business Today). The end result will likely be a combination of both.

The stage has been set for the adoption of virtual banking services and fintech. “For the last decade, new competitors have been unbundling financial services and delivering products that are highly personalized and delivered with speed and simplicity. In response, consumers have diversified the financial institutions they work with…” (The Financial Brand). The pandemic encouraged people to interact and pay digitally more than ever before and as a result, fintech adoption boomed worldwide with 88% of US consumers now use fintech solutions (Finextra).

USE CASES

Brands and retailers are trying to stimulate new forms of customer interaction in the metaverse to sell more products, fintech companies are seizing the opportunity to capitalize on new financial needs, while many startups are creating entirely new virtual products from avatars to cryptocurrencies.

Existing BFSI companies will be looking for new ways to promote their brand in the Metaverse by finding new ways of interacting with customers with their traditional services (Accenture):

- Banking: visit virtual branches for high-touch customer service

- Mortgage: take a house tour with a mortgage broker in real-time

- Advising: discuss retirement plans with an avatar advisor

- Investing: attend an investor event

- Education: participate in a bank-sponsored community program

- Employee Training: Bank of America’s deployment of VR training for 50,000 employees, simulates real customer service scenarios for branch employees.

BSFI investors or companies will also be looking for ways to cater to new services catalyzed by the Metaverse (The Financial Brand):

- Virtual payments

- Virtual mortgages

- Digital identity and authentication providers

- Financial data management companies and financial infrastructure companies whose job it will be to help facilitate value exchange in the virtual environment.

- Blockchain and digital asset companies

- Companies that develop virtual assistants and other AI-powered agents for financial services.

EARLY ADOPTERS

- JPMorgan is the latest bank to move into the metaverse with its Onyx lounge – the name refers to the bank’s suite of Ethereum-based services. (Accenture)(Business Today)

- South Korea’s Kookmin Bank allows one-on-one consultations and access to personalized financial information between customer and employee avatars in its virtual bank (Accenture) which consists of an entrance, VIP lounge, and main hall. They also plan to educate young people on finance as well as training employees. (Yahoo Finance)

- BNP Paribas has launched a VR app that allows customers to use VR in their banking transactions, including account opening, while Citi has tested holographic workstations for financial trading. (Accenture)

- The latest filing by the New York Stock Exchange to patent an NFT exchange points to the battle on the horizon: who facilitates payments and owns the payment rails in the metaverse? (Accenture)

RISKS AND MITIGANTS

The biggest risk appears to be missing out on key opportunities without being misled by hype. It would be wise to see how virtual banks adapting existing services (such as JP Morgan and KB in South Korea) fare in terms of adoption, before investing substantially in these efforts. On the other hand, investing in newer Metaverse enabling financial technologies provides a higher risk as well as the potential for higher reward.

MARKET OUTLOOK & QUOTES

- With 47% of bankers believing that customers will use augmented reality (AR) / virtual reality (VR) as an alternative channel for transactions by 2030, it’s no surprise to see early industry explorers in this area. (Accenture)(The Financial Brand)

- It took the internet took some 15 to 20 years to diffuse into banking. The mobile phone took a matter of five to six years. As we go beyond 2D to 3D, we can design an expansive universe with the ability to immerse customers. Banks should consider how banking would be enabled in a 3D world. (Accenture)

- While the pace at which the metaverse is expanding beyond gaming is unknown, we do know this next frontier is coming fast. And for banks, FOMO (fear of missing out) is greater than ever. (Accenture)

- How a brand remains relevant will need to evolve and banks will need to find new ways to build trust. As consumers build spaces across metaverse worlds, banks should not expect to simply move in and monetize. Instead, they should work to proactively build community. For inspiration, look outside of the industry. (Accenture)

- The financial services industry is moving faster than ever before and change will never happen this slowly again. As investments in new technologies and fintech firms hit record levels, traditional banking organizations are moving away from existing business models. (The Financial Brand)

- “I believe that this is potentially the most exciting time to be an entrepreneur in our financial history, the Metaverse, Blockchain, and Cryptocurrency technologies that we are poised to develop and deploy will change the financial landscape forever.” – Lynx CEO, Mike Penner (The Financial Brand)

- It is unquestionably true that almost all major tech players want to “own” their unique metaverse, not just Microsoft and Facebook. (Finextra)

- In reality, the most essential indicator of making the metaverse as indispensable as real life will be financial data management and techniques of managing financial transactions supplied by fintech solutions similar to real life. In a virtual world where you can buy and sell houses, products, clothing, land, and avatars just like in the real world, implies a massive economic ecosystem. (Finextra)

- Enabling 3D customer and employee experiences will be crucial for banking’s future in the metaverse, and those looking to gain early advantage will need to start enhancing capabilities now. Then, extend beyond simply “lifting and shifting” existing experiences into new AR/VR channels and start to reimagine how you can connect with clients, deliver advice and build relationships … all virtually. (Accenture)

- The Digital Banking Report asked banks, credit unions, other financial services providers including fintech firms, third-party solution providers, and advisors and consultants to the banking industry to provide their projections as to what will happen in the future. Here are some results (The Financial Brand):

FIGURE 1 – Modern Technologies

FIGURE 2 – Payments

FIGURE 3 – Crystal Ball Predictions for the Future of Banking

FURTHER READING AND SOURCES ON MARKET AND CURRENT INVESTORS:

- Michael Abbott, February 23, 2022. Banking in the metaverse: the next frontier. Available at: https://bankingblog.accenture.com/banking-in-the-metaverse-the-next-frontier. Accessed March 2022.

- Business Today, February 16, 2022. Available at: https://www.businesstoday.in/amp/latest/trends/story/jpmorgan-becomes-worlds-first-bank-to-arrive-on-metaverse-322803-2022-02-16. Accessed March 2022.

- Fasika Zelealem, November 30, 2021. South Korea’s KB Bank enters metaverse space. Available at: https://finance.yahoo.com/news/south-korea-kb-bank-enters-121438920.html?guccounter=1&guce_referrer=aHR0cHM6Ly9iYW5raW5nYmxvZy5hY2NlbnR1cmUuY29tL2JhbmtpbmctaW4tdGhlLW1ldGF2ZXJzZS10aGUtbmV4dC1mcm9udGllcg&guce_referrer_sig=AQAAAJB9u1VLTSOSZLeTXJeObk57CgfrGJlBLw5FlHZGwqHeLK6mKC08eHVcbKLFDQujWmkD2ko_BDlxA-zi_pQjsVObgr14n5jkBxvno5zs8WyY-ysBSjZvBe7SIi6A39Rn2tnDppCFWXuOKdKcTBFdwNuNuFwgg8msONRbKkzshkWn. Accessed March 2022.

- Grand View Research, March 2022. ‘Metaverse Market Size, Share and Trends Analysis Report.’ Available at: https://www.grandviewresearch.com/industry-analysis/metaverse-market-report. Accessed March 2022.

- Jim Marous, November 8, 2021. 14 Surprising Predictions on the Future of Banking. Available at: https://thefinancialbrand.com/124991/banking-future-projections-payments-technology-crypto-branches-competition-transformation-esg/. Accessed March 2022.

- David Finn, January 24, 2022. How Fintech is Embracing the Metaverse. Available at: https://finovate.com/how-fintech-is-embracing-the-metaverse/. Accessed March 2022.

- CBInsights. The Fintech 250: The Top Fintech Companies Of 2021. Available at: https://www.cbinsights.com/research-fintech-250?utm_campaign=marketing_fintech-250-2021_2021-10&campaignid=15901856335&adgroupid=132265684717&utm_term=fintech%20companies&utm_campaign=Reports&utm_source=google&utm_medium=cpc&utm_content=adwords-reports-company-lists&hsa_tgt=kwd-354241622567&hsa_grp=132265684717&hsa_src=g&hsa_net=adwords&hsa_mt=p&hsa_ver=3&hsa_ad=575352841148&hsa_acc=5728918340&hsa_kw=fintech%20companies&hsa_cam=15901856335&gclid=CjwKCAjwiuuRBhBvEiwAFXKaNLi-Xz5gw7P_cfK94JhZrifKE3UvuhCueHUOWy3gF89xSewnwe3-axoCVtsQAvD_BwE. Accessed March 2022.

- Yahya Mohamed Mao, December 6, 2021. Why fintechs will play a key role in the metaverse. Available at: https://www.finextra.com/blogposting/21364/why-fintechs-will-play-a-key-role-in-the-metaverse. Accessed March 2022.