APPENDIX 5

CRYPTOCURRENCY AND BLOCKCHAIN LANDSCAPE

CRYPTOCURRENCY AND BLOCKCHAIN LANDSCAPE

To clarify first, Bitcoin (a type of cryptocurrency) and blockchain are not synonymous, though they may be confused. Bitcoin relies on blockchain technology. Of the two, Bitcoin is the highest consumer of energy, though blockchain often gets a bad reputation because of its association with Bitcoin.

Cryptocurrency includes many different currencies, but we will focus on Bitcoin as a test case since it has generated the most publicity energy-wise. It has been said, “Today, Bitcoin consumes as much energy as a small country… such as Malaysia or Sweden” at around 110 Terawatt Hours per year — 0.55% of global electricity, but this figure taken out of context can be deceptive. Bitcoin mining is the primary consumer of energy, and is based on a computerized process called “hashrate”. The rate to sustain transactions of mined Bitcoin is substantially less. With energy usage based on hashrate, energy usage is easier to calculate. (Harvard Business Review)

Carbon emissions are the main problem, however, rather than the source of the energy. Carbon emissions are much harder to estimate as it involves considering the energy mix (renewable versus non, and energy type) used to create the Bitcoin. Determining the carbon emissions is difficult because it is based upon location and the “energy landscape”, which is still a difficult proposition as some geographical areas have a greater diversity in the energy landscape. Estimates of carbon neutrality vary between 73% in areas with more renewable energy, down to 39% in other areas. (Harvard Business Review).

SOLUTIONS

A positive aspect of Bitcoin mining is that it is able to utilize wasted energy sources since it can be mined from anywhere. A circular carbon economy is the ideal as we seek to capture, utilize, and store carbon when possible. Some examples from (Harvard Business Review):

- Utilizing wasted hydro energy from remote dams in China where it’s not practical to store and transport energy. Instead, Bitcoin miners have relocated there. “These regions most likely represent the single largest stranded energy resource on the planet, and as such it’s no coincidence that these provinces are the heartlands of mining in China, responsible for almost 10% of global Bitcoin mining in the dry season and 50% in the wet season.” However, it appears that China has since banned Bitcoin mining creating complications for miners who must consider how or where to move (Hashrate Index). Miners “lost their access to hydropower from regions within China that had powered their computers with cheap, plentiful, renewable energy during the wet summer months” and have moved on to “dirtier” areas with less renewable energy (The New York Times).

- Utilizing wasted flared natural gas from oil extraction. “Of course, this is still a minor player in today’s Bitcoin mining arena, but back of the envelope calculations suggest that there’s enough flared natural gas in the U.S. and Canada alone to run the entire Bitcoin network.”

- The aluminum industry recognized wasted energy and capitalized on it since smelting ore for aluminum consumes massive amounts of energy. They built smelting centers around wasted sources of energy, some of these even have been now converted to Bitcoin mining centers.

The aggregate share of renewables in Bitcoin mining energy sources.

| Region | Regional average share of renewables | Regional share of Bitcoin hashpower | Regional weighted share of renewables in Bitcoin mining |

| Asia-Pacific | 26% | 77% | 20% |

| Europe | 30% | 10% | 3% |

| Latin America & Caribbean | 20% | 1% | 0% |

| Middle East & Africa | N/A | 4% | N/A |

| North America | 63% | 8% | 5% |

| Global | – | 100% | 29% |

SOURCE: 3rd Global Cryptoasset Benchmark Study by the Cambridge Centre for Alternative Finance via Data Driven Envirolab

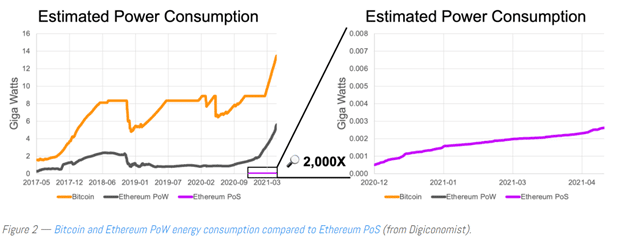

It is worth noting that all cryptocurrencies do not have the same energy consumption and there are some newer ways for generating cryptocurrency that are less energy intensive. The process for mining cryptocurrency is complicated when it comes to generating consensus needed for mining, and these processes are diversifying so that they don’t all rely on computational power. Bitcoin and early versions of Etherium relied on the Pow (Proof-of-Work) method which relies on computational power. However, Ethereum has switched to a PoW (Proof-of-Stake) which is based upon validator nodes only requiring economic resources like network tokens. The transition from PoW to PoS reduces the Ethereum total network’s energy consumption by at least 99.95% (Data Driven Envirolab).

FIGURE A – Bitcoin and Ethereum PoW energy consumption compared to Ethereum PoS

SOURCE: Digiconomist via Data Driven Envirolab

Bitcoin’s high energy consumption is almost exclusively inherent to the Bitcoin network due to its architectural and governance design choices. High energy consumption is not intrinsic to blockchain technology in general… [which] depends on its consensus mechanism, determining what information is added to the network ledger. (Data Driven Envirolab)

Other consensus mechanisms are being explored both for Bitcoin and blockchain, including PoA (Proof of Authority) which have the potential for disrupting the trajectory of energy usage. The difficulty lies in balancing the environmental impact with security needs (Data Driven Envirolab):

These mechanisms have different design specifications relating to network governance and authority distribution, reflecting trade-offs between network decentralization, scalability, and security. Due to these trade-offs, blockchains have specific strengths and limitations that must be carefully matched with the respective use case requirements. (Data Driven Envirolab)

When looking to assess whether cryptocurrency is worth the environmental impact, it might not be as bleak as originally thought when factoring in renewable energy, CCUS (carbon capture, utilization, and storage), and alternative methods of mining. Additionally, the Crypto Climate Accord — inspired by the Paris Climate Agreement — advocates for and commits to reducing Bitcoin’s carbon footprint (Harvard Business Review). When looking at blockchain, it would be valuable to assess different consensus methods and their ability to balance security and energy considerations. (Data Driven Envirolab)

SOURCES AND FURTHER READING

- Nic Carter, May 2021. ‘How much Energy does Bitcoin Actually Consume?’ Available at: https://hbr.org/2021/05/how-much-energy-does-bitcoin-actually-consume. Accessed March 2022.

- Marco Schletz, August 2021. ‘Blockchain Energy Consumption.’ Available at: http://datadrivenlab.org/climate/blockchain-energy-consumption-debunking-the-misperceptions-of-bitcoins-and-blockchains-climate-impact/. Accessed March 2022.

- Hiroko Tabuchi, February 2022. ‘China Banished Cryptocurrencies.’ Available at: https://www.nytimes.com/2022/02/25/climate/bitcoin-china-energy-pollution.html#:~:text=China%20Banished%20Cryptocurrencies.-,Now%2C%20’Mining’%20Is%20Even%20Dirtier.,uses%20far%20less%20renewable%20energy. Accessed March 2022.

- Colin Harper, June 2021. ‘China Banned Bitcoin Mining.’ Available at: https://blog.hashrateindex.com/bitcoin-mining-ban-china-hashrate-migration/. Accessed March 2022.